What is Industrial Research?

Industrial Research

There is a difference between academic and industrial research. It is not the quality of the research, good research shines wherever it is conducted, but it is the research purpose that changes. The change in purpose shapes how companies conduct research and why we in industrial research often focus on different aspects than our academic colleagues.

Defining Research

If you do a Google search for “What is research?” you’ll see the following:

Research:

noun: the systematic investigation into and study of materials and sources in order to establish facts and research new conclusions.

verb: investigate systematically

Within the academic world it is possible to systematically design and run a set of experiments to validate or disprove a hypothesis. The results of the research could be a positive finding “New technology Y provides a 20% performance increase over existing methods” or it could be a negative finding “Hey method Y really sucks; it provides a 20% performance penalty. I suggest no one ever uses it”. Both outcomes are equally valid and important contributions to the body of knowledge that the world shares.

Defining Industrial Research

Unfortunately, Google doesn’t provide a definition of “Industrial Research”, but the European Union provides its own official definition which is pretty much spot on:

‘industrial research’ -

means the planned research or critical investigation aimed at the acquisition of new knowledge and skills for developing new products, processes or services or for bringing about a significant improvement in existing products, processes or services.

Industrial research is similar to, but distinct from, academic research. Both fields share the same rigour, although their goals are different. Within the academic world success can be defined as discovering new knowledge. But within industrial research success is new knowledge that leads to new products, processes or services. It is a subtle but important difference which affects the type of research and hence work that industrial research teams undertake.

Introducing the Technology Readiness Level (TRL)

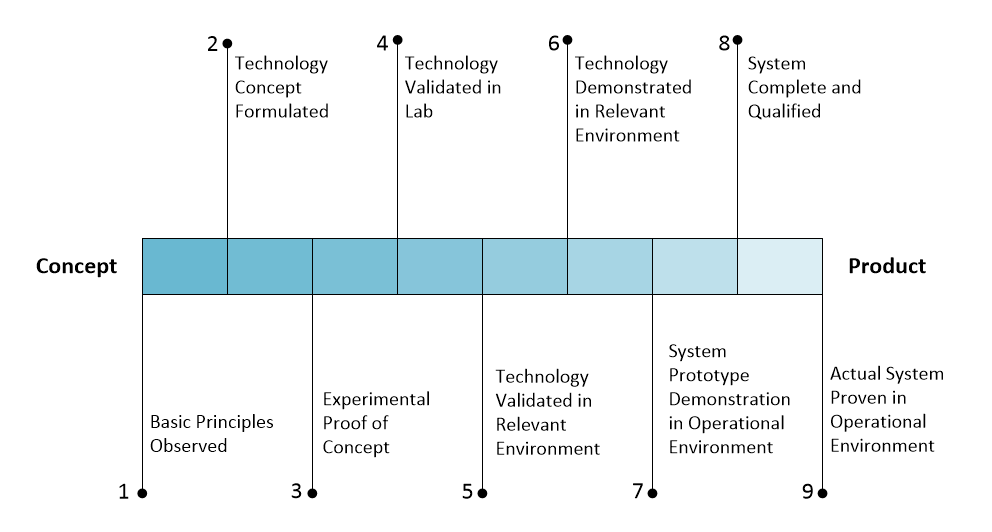

Research can mean a lot of things, from understanding some fundamental law of physics through to producing a working prototype of a new product. This is a huge scope and it makes talking about research difficult. NASA had the same issue; they were speaking to researchers at a range of different organizations and they needed a way to understand how far their research was from something that could actually fly. To address this NASA invented the TRL scale (Technology Readiness Level). This approach is so useful that it has also been adopted by other US Government departments, universities around the world and the European Union. NASA’s TRL scale currently has 9 levels, with level 1 (TRL1) being basic research. Basic research is core fundamental research, like understanding the structure of an atom for instance. TRL9 is a product that is ready to purchase and use out of the box. The intermediate levels describe a process from TRL1 to TRL9, so TRL 4 is basic proof of concept of a part of an idea that works in a Lab, TRL 5 is the same proof of concept working in the real world. TRL6, 7, and 8 describe a proof of concept as it matures from tech demo to a pre-production system.

You can read more about TRL scale on Wikipedia, including details on the NASA scale. You can read more about the EU’s TRL scale on the EU website.

How Companies Structure Research

Because of this push to deliver research which leads to new products, processes or services, it affects where companies invest into research. There is no hard and fast rule, however it is not unusual to see a large number of organizations invest in higher TRL research. This means that most organizations are not investing in developing a core technology, but are investing in how to apply core technology or research to their day to day business. This is often referred to as applied research.

There are a number of other organizations who take a longer-term view, organizations like Bell Labs are famous for conducting both fundamental and applied research. These types of organizations have a longer-term approach to the market place and to research. This decision basically comes down to finances and how much time (money) they will spend researching before needing to see a return on their investment. However, as a general rule, most industrial research teams will focus on TRL4 and up; some focus exclusively on bringing technology to market and will and will therefore aim for proof of concept stage and higher.

Industrial Research and the Business Landscape

The purpose of industrial research is to improve an existing product, service or to create a new product or service. As technical researchers we often have a great understanding of the underlying technology and that is important, but it is not enough by its self. An industrial researcher also needs to understand the business environment.

The business environment is everything from the cost of a product or service through to how it can be marketed, identifying the ultimate customer, finding out what competitors are doing, and even what the law and the policy makers are saying. These all influence the viability of a product, concept and technology.

The business environment is constantly changing with new technologies and the introduction of new business models. So, it is important to not only consider the business landscape today, but what the landscape of tomorrow might look like. There are a whole body of researchers dedicated to trying to predict or visualise what the future might look like.

The Industrial Research Advantage

I had the chance to meet Donald Strickland. He was giving a course I was attending. As I recall he stood at the front of lecture room and asked all of us the same question, “What is the role of a CEO?”

“To run a company?” someone behind me shouted.

“No, that’s the COO - Chief Operating Officer” Donald answered, he went on to explain, that the role of a CEO was to discover how your business is going to be disrupted and destroyed by a competitor and to go ahead and do that before they do.

This advice stuck with me, because Donald Strickland is the guy that presented the idea of a consumer digital camera to Kodak. At the time Kodak was a large multinational which made cameras and film for everyone, from hospitals and X-Ray machines, through to movie studios and all of the available consumer cameras at the time. The Board of Kodak saw Donald’s proposal as a threat, they were worried, that they made digital cameras people would stop buying film. As a result, Kodak turned the proposal down. Donald tried three times and each time it was refused. Donald left Kodak and joined Apple.

The board of Kodak were right, people would stop buying film. Kodak’s competitors introduced digital cameras and in 2012 Kodak went out of business.

The world is constantly changing. While we can make money selling the technology of today, tomorrow it will be out of date. We need to be open to understanding both the technology and business market place, when we do that, we can be ready, as Donald put it, to disrupt our market place before a competitor does it.

Ultimately Industrial research provides CEOs and business owners the ability to envision new products and services but it also enables them to explore how their industry could be disrupted and how they can turn the disruption into an advantage. As a consequence, research teams in most companies will sit close to the CEO or ‘c suite’ so that they can provide insight and future vision to help shape the company’s future.

Next time

In this post I’ve talked a lot of about what research is but not how to conduct it. In the next article we will start to explore the methods of research and how it is conducted in industrial departments. In the meantime, when you look around your own workplace and the products or services your company offers, consider if there are any areas where you think disruption to production might happen.